Our society today is very technologically advanced. We do so many things on line whether its banking, ordering food or buying goods. To make that happen, we generally need a credit card. They can be wonderful tools to have but can also create massive issues when not used correctly or respected properly. Below is a list of some of the main pros and cons about credit cards. I am sure there are others in both categories and it would be awesome if we had the opportunity to share them with everyone. So please if you know something important I have missed based on your own personal experience please message me and I will incorporate it into the post

Pros of credit card use:

1. Helps to build credit. It seems crazy but you have to use credit to actually build credit. If you buy everything with cash lending institutions have no idea if you are capable of making regular payments. Using a credit card and paying on it regularly produces good credit and the results can be better rates on house mortgages, car loans and other credit cards.

2. You dont have to carry cash. And if you lose the credit cards or have them stolen you get protection from the credit card companies with something called fraud protection. If reported immediately there will be little or no charge to you. Whichever bank/card you use make sure to read and understand the fine print out about fraud protection. KNOW YOUR RIGHTS!!

3. Track your spending. Have you ever noticed how easy it is to spend cash? I am a huge fan of using cash but it has its pitfalls. With credit cards it can actually be easier to stay on a budget. You can use your credit card statements or get updates on the balance There are apps you can use to track spending, provide budgets and generally give you a better idea of how you spend your money. The only way the apps work is if you have a record of your spending.

4. Earn rewards and perks. Many or most cards provide perks when using your credit card. You can build up points to be used for travel rewards and other such things. One of the big perks can be built in car insurance for renting a car. This can be expensive but many cards have this already installed as a feature. Again, know your rights with the card. Check out the link below to see which cards provide some of the best perks. Keep in mind the fees for maintaining these cards might not make it worth it.

Cons of credit card use:

- Potential to overspend. Sometimes it seems too easy. Just pull out that card and swipe. But the reality is overspending is incredibly easy without some discipline from the cardholder. Once that happens you are then officially in debt. And getting out of credit card debt is one of the hardest things young people will ever do. There can be massive pressure applied to you internally when you fall into credit card debt. The interest rate makes it almost impossible to get ahead. Concerns about your balance and being able to use your card at all are a very real issue

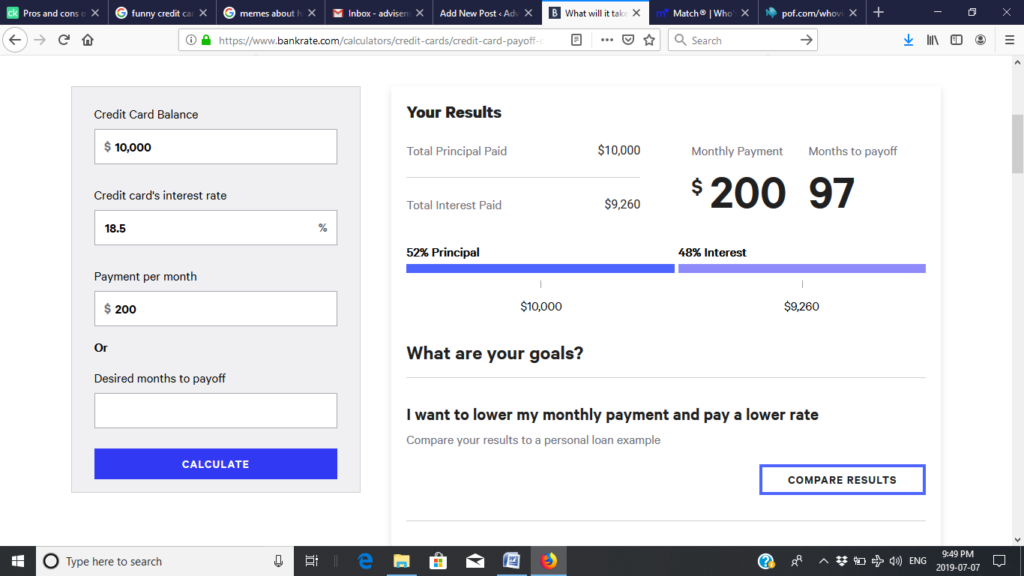

Below is an example of what 10,000$ in debt looks like when trying to pay it off

Here is the link for the website so you can input your own numbers to see.

https://www.bankrate.com/calculators/credit-cards/credit-card-payoff-calculator.aspx

2. Fees and interest rates. With most credit cards you will be paying any annual fee for the card. The fees will usually be in the 120-150$ range but can be a little higher or lower depending. As for the interest rates, These can vary as well. Companies tend to offer low rates for s specified amount of time to get your business but the reality is you will be paying nearly 20% on any balance you carry from month to month. See below for some possible best rates available on cards.

3. Can negatively affect your credit score. Improper use of your credit card can have a serious affect on your credit score. If you have a low credit score this will seriously impede your chances of getting a mortgage/car loan/personal loan. The best way to minimize the effect is to make regular payments on time. But just know that if you are carrying a high balance in relation to your available credit your ability to borrow money will be affected. See below for a description of what a credit score is in Canada.

https://www.debtcanada.ca/library/credit-rating-101

So those are the pros and cons as stated by various sources. Please feel free to search other sites for yourself to see what others have to say about the pluses and minuses of owning and using credit cards.

Like most things in life, there are pros and cons to using credit cards. If you’re smart about how and when you use your plastic, a credit card can prove to be an essential and useful financial tool.

If you allow your spending to get ahead of you and you’re not organized when managing payments and accounts, credit cards may do more harm than good.

If and when you decide to apply for a credit card, make sure you pick the one that’s the best option for you

And now my personal opinion. Since I was like 15 years old I had a credit card. My first card was linked to my fathers account. I learned the hard way about not making payments an unfortunately it fell on my dad to bail me out a couple of times because I was too busy spending other money I didnt have to make the necessary payments. It was embarrassing and humbling to say the least. And making basic payments will never let you catch up

In the ensuing years I have used the cards much more wisely. I better understand the ramifications of pulling out the plastic and I do it now when it is required. They have granted me all sorts of bonuses and perks including booking hotels and rental cars using points I have built up. I havent always done a great job of paying them off monthly but its far better than it ever was. And paying the bill off every month is literally the only way they work for you. Keep it in mind and spend wisely.

I have also had my credit card information stolen. Its simple when you travel abroad. You are required to supply a credit card to any hotel you stay in. Just keep in mind that any card reader can extract your information and copy the card. From there the clever a-holes out there can use your card to make purchases before the card can be cancelled. Its one of the main reasons informing your credit card company if your impending travel. they would then recognize if unwanted purchases are being made

Also remember to switch cards as and when required. Dont stay with a certain card “because I always have or thats who my parents use”. You will generally get better rates when starting with a new company and it can be a good way to help you catch up. And just remember when people tell you to maintain a balance on your credit card to help improve your credit rating a balance can be 1$ or a 1000$ and the effect is the same.

As previously mentioned I am hoping any readers out there will share their own views on credit cards. It can be a contentious subject to say the least but talking about it will always make us better informed in the long run